Unraveling the Intricacies of the Iron Lot

Diving into the world of metal trading, one cannot overlook the significant concept of the “Iron Lot.” Not only is it a crucial unit of measurement within the industry, but it also offers a profound perspective on the commercial landscape of metals, particularly iron. As a fascinating convergence point of economics, industry, and mathematics, the Iron Lot can be used to evaluate the complex interconnections that drive global commerce.

1. The Concept of an Iron Lot

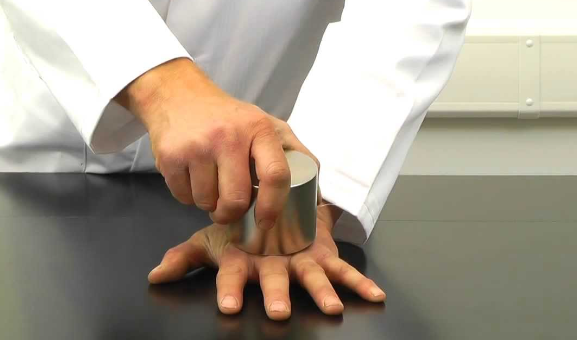

An “Iron Lot” is a term originating from the metal trading and recycling industry. It refers to a specific quantity of iron that’s used as a standard measurement within the industry. It provides a consistent and universally accepted scale to compare the quality, price, and weight of iron, effectively smoothing the process of trade and negotiation.

The introduction and standardization of the Iron Lot have simplified transactions and contracts, leading to a more efficient marketplace. Traders, buyers, and sellers worldwide now have a shared language that transcends geographical and cultural barriers.

2. The Mathematics Behind the Iron Lot

In this section, we delve into the math behind the Iron Lot. Essentially, it revolves around a simple arithmetic operation that converts weight to the number of lots. A single Iron Lot typically represents a metric ton (or 1000 kilograms) of iron.

This simple conversion unit, while straightforward, is instrumental in driving the efficiency of the global iron market. Transactions can occur rapidly, with clarity and precision, thereby reducing the risk of misunderstandings or conflicts.

3. Iron Lot in Global Commerce

The Iron Lot plays a pivotal role in global commerce, particularly in the iron and steel industry. Given the large scale at which iron is traded globally, having a universally understood unit like the Iron Lot is vital.

International transactions hinge on a shared understanding of measurements and values. As such, the Iron Lot forms the bedrock of these exchanges, fostering clear communication and setting the stage for successful, fair trade.

4. Iron Lot and Market Fluctuations

In the fluid world of commodity trading, the Iron Lot serves as a constant. Its value does not change with market fluctuations, unlike the price of iron itself. This makes the Iron Lot a crucial tool for traders looking to hedge their bets against volatile markets.

This ability to provide a measure of stability amidst the capricious nature of commodities markets underscores the importance of the Iron Lot. It not only facilitates trade but also aids in strategic planning and risk management.

5. Environmental Implications of the Iron Lot

Lastly, the Iron Lot has environmental implications that are worth examining. Given the increasing focus on sustainability and responsible trading practices, measuring iron in lots can help to monitor and control the amount of iron being extracted and traded globally.

Keeping track of the number of Iron Lots traded can help authorities and organizations track the environmental footprint of the industry. This way, the Iron Lot can contribute to more sustainable practices within the industry, offering a model for other sectors to follow.

Conclusion: The Value of the Iron Lot

The Iron Lot, though initially appearing as just a measure of iron, is a symbol of the interconnectedness of global trade, the precision of mathematics, and the growing importance of environmental consciousness in our world. Its impact is far-reaching, shaping the way we trade, communicate, and consider the world around us. As we delve deeper into the 21st century, the role of the Iron Lot will likely only grow more critical.